Micro-Foundations of Financialization: Status Anxiety and Consumer Credit in Chile

Felipe González

Most Chilean families are indebted to department stores or banks. Felipe González asks why. Are they consumerists, or do they simply use credits to protect their lifestyles? Arguing that none of these traditional depictions of indebtedness suits the case of Chile, González investigates why people acquired so much consumer debt in contexts of material prosperity and asks what the role of inequality and commodification is in this process.

Chile seems to be a typical case of the financialization of consumption, a country in which the embrace of neoliberal policies – trade liberalization, commodification, labor flexibility, and cuts to social spending – was followed by an explosive expansion of the market for consumer credit.

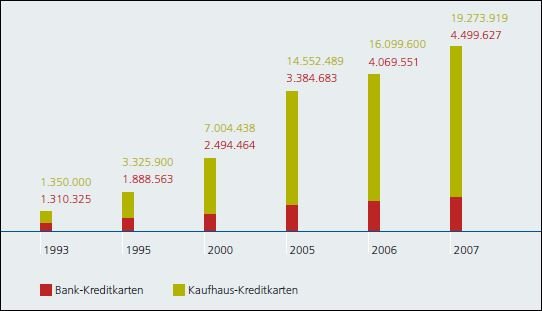

Facilitated by the financial innovations carried out by department stores in the 1970s, the market for consumer credit began to penetrate Chile weakly in the late 1980s, but it has exploded over the last two decades (see Figure 1). By 1995, one and a half million households already had consumer debt, and five million credit cards were circulating in a country of fifteen million inhabitants. According to the last report of the Financial Retail Committee, by April 2015 there were at least twenty million credit cards circulating among Chilean families. And as the most recent Household Financial Survey conducted by the Central Bank of Chile in 2014 reports, consumer debt is held by 63.4 percent of households, homogenously distributed across all income groups.

The Chilean case raises an important challenge to the literature. Insofar as existing accounts are based on the recent history of developed countries and assume that the financialization of consumption occurs in contexts marked by wage stagnation and a general deterioration of the middle classes, they engender two contradictory explanations that do not necessarily hold true for the Chilean case – or arguably other developing countries.

»The financialization of consumption usually occurs in contexts marked by wage stagnation and a general deterioration of the middle classes; but not in Chile.«

Explanations for rising consumer debt

On the one hand, economists suggest that, in a context of inequality, consumer debt stems from the fact that middle income consumers seek to emulate the lifestyles of the rich. More specifically, the narrative goes on to say that inequality sharpens social differences by concentrating wealth at the top, which, in combination with stagnant wages in the middle of the income distribution, creates pressure on the non-rich to emulate the increasing expenditures of better-off consumers. Income inequality is thus implicitly conceived of as a form of social differentiation whereby one group – top earners – shapes the consumption of the rest – the non-rich – and consumers systematically use credit to close the gap between rising aspirations and economic constraints (wage stagnation).

On the other hand, a different explanation for rising consumer debt has gained salience in the financialization literature in the aftermath of the financial crisis of 2007 and 2008. It stresses that neoliberal policies have prompted households to acquire consumer debt, thus transferring the financial burden from the state to households, a process known as the “privatization of risk.” In this tradition, scholars have argued that consumer credit is not used by middle-income consumers to emulate the lavish consumption of wealthier consumers, but rather helps people “smooth their consumption" and meet their financial commitments in the context of the rising cost of living, market volatilities, and stagnant wages.

In a few words, while political economists argue that people use credit in order to smooth their consumption in the face of market volatility, economists maintain that the concentration of wealth at the top pushes middle-income consumers to emulate the expenditures of the rich and consume beyond their means. But are these two explanations irreconcilable, and do they hold true in developing countries as well? The answer is that they do not. These two competing hypotheses fall short of explaining the crucial features of indebtedness in general as well as the indebtedness of Chilean households in particular. There are at least in two significant ways in which this is the case.

Reasons for rising consumer debt in Chile

In Chile the expansion of consumer debt has been grounded not in the deterioration of the middle class in the post-Keynesian period as in many capitalist democracies, but in the context of unprecedented growth and a significant improvement in the standard of living for large segments of the population.

The second problem is that the indebtedness of Chilean households does not seem to fit either of these two ideal types of consumption practices. In contrast to the privatized Keynesianism hypothesis, Chileans do not resort to debt in order to cope with emergencies and smooth their consumption. Rather, they expand their purchasing power and buy goods, a practice known as “grabbing something from the department store.” This does not necessarily mean that consumers seek to gain status by exhibiting wealth in the form of luxury goods, fancy vacations, up-to-date clothing, vehicles, and so on. Chileans instead seem to acquire a standard package of durable goods that are, in many cases, “invisible.” That is, they use consumer credits for what experts in consumption studies call “ordinary consumption,” goods that do not signal status to others, such as kitchen appliances, construction supplies, standard furniture, and electronics.

»Unprecedented growth and a preference for ordinary consumption have led to the expansion of consumer debt and to a significant improvement in the standard of living.«

Thus, the financialization of consumption in Chile poses two important questions: first, why do people become indebted in a context of growth and upward mobility; and second, if neither defensive nor conspicuous consumption drives consumers, what role does the socially constructed standard of living play?

Obviously, people use credits because they are not able to meet the socially established standard of living. In other words, the systematic rise in household debt reflects an existing gap between incomes and aspirations. This gap, moreover, is expressed in social discomfort that takes the form of major concerns about “rank,” “achievement,” or “security" – depending on the structural forces at stake – which is called “status anxiety,” Status anxiety does not stem from the desire to emulate rich consumers, but from the impossibility of complying with normative expectations about what a middle class family should be (and have) that outpace wage improvements.

Most Chilean families use credits in order to perform their class identities and meet the consumption standards to which they feel entitled – in other words, to perform their belonging to an “imaginary middle class.” Thus, building on the idea that consumer debt is used to fill a gap between income and a socially constructed standard of living, financialization might be explained by three subtler mechanisms: spurious upward mobility, relative deprivation, and income draining.

Unlike common discourses that blame the poor for being consumerist, this explanation assumes that their indebtedness has less to do with conspicuous or defensive forms of consumption. It is rather a progressive ratcheting up of the standard of living together with a lack of opportunities to fulfill these expectations. The mechanism driving the demand for credit among poorer consumers in Chile is the following: with the aid of social policies specifically targeted at the bottom twenty percent of households – which spend an average of forty-five percent of their budget on food and transportation – many families moved above the poverty line. That means they earn approximately 170 USD per month. Through that aid they became homeowners and enjoyed material improvements. However, this new standard of living and these rising aspirations were not accompanied by better opportunities in the labor market, thus excluding many families from the new consumption trends in Chilean society. In this context of “spurious upward mobility,” “absolute poverty" was replaced by “relative poverty.” Department stores became for many the only place where they were able to buy those goods to which they increasingly considered themselves entitled.

»In the context of ›spurious upward mobility‹, ›absolute poverty‹ was replaced by ›relative poverty.‹«

In the process of becoming homeowners with the help of subsidies and moving out of abject poverty, many Chilean families progressively learned how to incorporate small credits into their budgets, pay installments on time, and ensure their permanent access to goods that they would otherwise not have been able to afford. The status anxiety of these consumers is revealed in two ways: First, even though their situation has improved, they feel excluded from the benefits of growth. Second, due to the “spurious upward mobility" facilitated by social policies, they tend to overestimate their objective status.

»Chilean households realize their expectations and class identities in a context of improvement.«

The second mechanism generating debt among middle class consumers stems from an increase of real wages and high levels of inequality. It is explained by a general sociological principle known as “relative deprivation,” which points to the fact that general satisfaction with one's income, possessions, or status is assessed not in absolute terms such as total income, but in relation to reference groups. Relative deprivation works as follows: Middle-income consumers have experienced upward mobility facilitated by a rise in real wages. Nevertheless, in a context of upward social mobility across all income groups and persistent inequality, the standard of living has improved in absolute terms, but social mobility and improvement have gone unnoticed in relative terms. This triggers relative deprivation, expressed in dissatisfaction with one's own income among middle-income consumers. Unlike the spurious upward mobility mechanism of the poor, the status anxiety of middle-income Chilean households is characterized by the fact that they underestimate their objective status while overestimating the wealth of others. Rather than imitating consumers above them in the social hierarchy, however, the gap between the incomes and aspirations of these consumers is realized in an “imaginary middle class.”

The use of credits and how Chilean households realize class identities

Five practices demonstrate a clear connection between the use of credit and the way in which Chilean households realize their expectations and class identities in a context of improvement. This shows that their indebtedness is mainly driven by the acquisition of “ordinary goods” that ratchet up consumption standards at a higher pace than wage improvements.

-

Middle-class consumers who experience intergenerational mobility deploy a wide range of material practices to improve, decorate, and furnish their new homes in order to match their new and “authentic" class identities. In this regard, becoming a homeowner and moving into one's own home becomes the most important milestone in the acquisition of consumer debt and learning how to incorporate debt into everyday economic practices.

-

Whatever the nature of the products they purchase, consumers consistently report that they use their department store credit cards to purchase things they consider “necessary.” In many cases, “buying what is necessary" means managing care relations, such as giving birthday gifts or buying presents for graduations, weddings, or other ceremonies, as well as equipping loved ones with consumer goods that people consider worth having. In this sense, people are not using credit cards to access goods that were previously out of reach, but to improve the level of quality of the goods to which they already have access.

-

Consumers who experience upward mobility see credits as a source of recognition and a means of erasing the stigma of poverty.

-

For some consumers who do not receive a wage income, such as housewives dependent on money from their spouses, for example, department store credit cards offer a means of experiencing financial independence that they do not enjoy in the labor market. In this way, credit provides a means of realizing the economic independence of the “imaginary middle class,” which in this context means going out, shopping without saving in advance, and using credit to purchase something impulsive, unusual, or unplanned.

-

Finally, the commodification of education, health, and pension funds does not directly prompt people to acquire consumer debt. They operate as “income draining" mechanisms that demand higher shares of middle class families' “discretionary income.” In combination with “relative deprivation,” these “income draining" mechanisms leave families with few options to perform their desired class identities, other than learning how to bring resources from the future into the present with the help of department store credit cards.

In contexts of rising middle classes and persistent inequality, consumer credit fills the gap between more demanding standards of living and an uneven distribution of the benefits of economic growth. These mechanisms may well be replicated in other developing countries that are experiencing financialization processes alongside a rise in real wages.